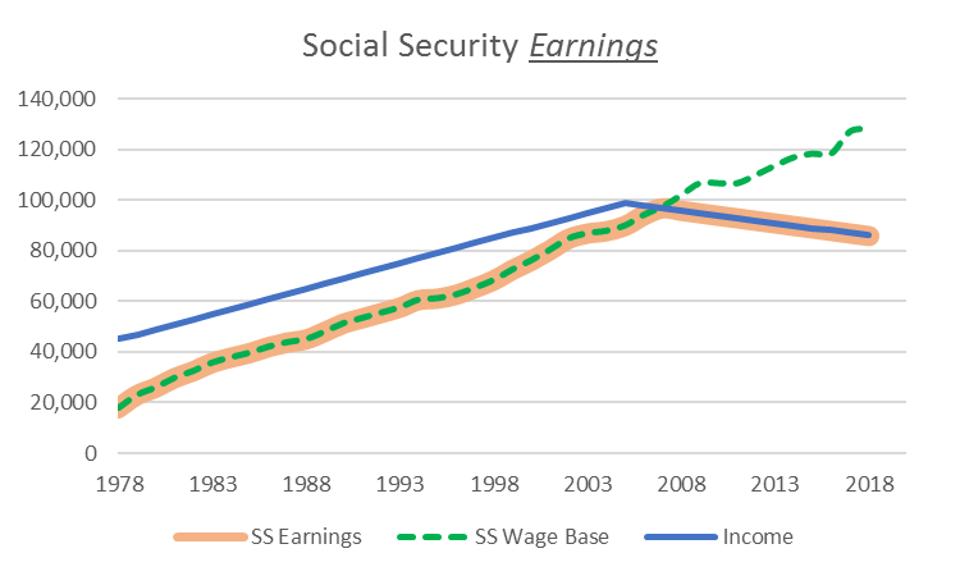

If you are working, there is a limit on the amount of your earnings that is taxed by social security. We raise this amount yearly to keep pace with increases in average wages.

If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. For example, if you retire at full retirement age in 2025,.

This amount is known as the “maximum taxable earnings” and changes each.

Social Security 2025 Earnings Limit Lynna Rosalia, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). What is the maximum social security benefit in 2025?

Max Taxable For Social Security 2025 Sarah Cornelle, What is the maximum social security benefit in 2025? The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873.

Social Security Maximum Taxable Earnings 2025 Diann Florina, What is the maximum social security benefit available? Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Social Security 2025 Earnings Limit Ashil Calypso, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings.

Ssi Household Limits 2025 Sonja Eleonore, This amount is also commonly referred to as the taxable maximum. It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62.

What Counts Towards Social Security Earnings Limit 2025 Geneva, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. If this is the year you hit full retirement age, however, the rules are a.

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, Up to 50% of your social security benefits are taxable if: For earnings in 2025, this base is $168,600.

Social Security Tax Limit 2025 Check Maximum Taxable Earnings & How It, This amount is known as the “maximum taxable earnings” and changes each. This amount is also commonly referred to as the taxable maximum.

5.2 Increase to Social Security Maximum Taxable Earnings in 2025 YouTube, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per. Be under full retirement age.

Social Security Cap On Earnings 2025 Erin Odessa, There is no earnings cap after hitting full retirement age. The maximum amount of social security tax an employee will have withheld from.

This amount is known as the “maximum taxable earnings” and changes each.

2025 Taylor Swift Concert Dates March 2, 3, 4, 7,…

2025 Rx 350h Luxury Mpg Standard, premium, premium+, luxury, f…

Chevy Colorado 2025 Mpg Chevy says it should average 16…